FinYX Fund SPC

FinYX Fund SPC is a Cayman-regulated quantitative fund managed by FinYX (Cyprus) Investments Ltd. The fund offers two different strategies: Intraday and Multiday. Within our strategic toolkit, we employ advanced AI machine learning, rule-based algorithms, and robust statistical methodologies. These capabilities enable us to excel in the world's most significant capital markets, consistently generating remarkable returns, regardless of the prevailing market landscape. Join us on the path to financial success and discover the power of FinYX Fund.

FinYX Systematic Edge

Intra-day strategy trading US equity index futures, using in-house developed algorithms and combining multiple uncorrelated signals in order to generate absolute returns with minimal correlation to the market.

With proven track record in the world’s leading capital markets and across multiple assets, FinYX is constantly seeking to capitalize on new and challenging opportunities.

Key Factors and Statistics

Figures are updated as of 30-Sep-2025

47%

Net Annualized Return

2.7

Sharpe (Net)

85%

Positive Months

14%

Max Drawdown

Past performance is not necessarily indicative of future results.

The performance information presented herein should be read in conjunction with the most recent Fund Fact Sheet, which provides detailed explanations of the parameters used in calculating the figures shown, including performance calculation methods, applicable fees, differences among account types, and any use of hypothetical or simulated results.

This material does not constitute an offer to sell, or a solicitation of an offer to buy, any interest in the Fund. Prospective investors should carefully review the Fund’s Confidential Offering Memorandum and consult their professional advisers to determine whether an investment in the Fund is appropriate in light of their investment objectives, financial situation, and risk tolerance.

The Offering Memorandum contains important information regarding investment risks and other material considerations, and must be reviewed thoroughly prior to making any investment decision.

Simulated and back-tested performance benefits from hindsight and does not reflect real trading conditions, including liquidity constraints, transaction costs, market disruptions, leverage, or capital requirements.

Unlike an actual performance record, simulated results do not represent actual investment activity, and in the context of an overall portfolio, the results may have under- or over-compensated for the impact, if any, of certain factors such as market factors, available liquidity, expenses incurred in pursuing the investment strategy, access to leverage, the need to invest capital, market disruptions, the effect of interest rates, and the perceived attractiveness of available opportunities at any given time. The back-tested performance results also benefit from the fact that the simulation was designed with the benefit of hindsight. As a result, actual performance may differ significantly from the hypothetical performance results displayed herein. There can be no assurance that FinYX would have taken or will take positions similar to those taken in the results presented. There are frequently sharp differences between the hypothetical performance results and the results subsequently achieved by any particular trading or investment program.

No overnight exposure

Fully Automated Proprietary System

Mid-Frequency Execution

Equity index futures

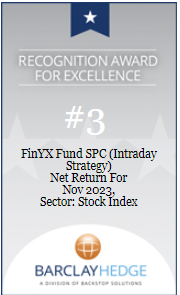

Awards

For more information about the awards, categories and ranking methodology, please visit the respective websites:

https://ionanalytics.com/barclayhedge/rankings/

https://awards.internationalfinance.com/award-categories/

https://awards.withintelligence.com/eurohedgeawards/en/page/home